Aflac provides supplemental insurance policies designed to bridge the gaps left by primary health insurance plans. These policies pay cash benefits directly to policyholders, helping them cover out-of-pocket costs like deductibles, copayments, and other expenses not fully covered by traditional insurance. Whether you're dealing with a medical emergency, a critical illness, or even a temporary disability, Aflac steps in to ease the financial burden. Understanding how Aflac works requires a closer look at its policies, claims process, and the unique value it brings to policyholders. In this guide, we’ll explore everything you need to know about how Aflac works, from its origins to its current role in the insurance landscape. We’ll break down the types of policies Aflac offers, how claims are processed, and the benefits of choosing Aflac as part of your financial safety net. Whether you’re considering purchasing a policy or simply want to learn more, this article will equip you with the knowledge to make informed decisions.

- What Is Aflac and How Does It Work?

- How Does Aflac Work? What Are the Types of Policies Offered?

- How Does Aflac Work? What Are the Benefits of Aflac Policies?

- How Does the Aflac Claims Process Work?

- Is Aflac Worth It? How Does Aflac Work for You?

- How Does Aflac Work for Employers and Businesses?

- How Does Aflac Work? What Are the Common Misconceptions?

- Frequently Asked Questions About How Aflac Works

What Is Aflac and How Does It Work?

Aflac, founded in 1955 by brothers John and Paul Amos, started as a small family business in Columbus, Georgia. Over the decades, it has grown into a global leader in supplemental insurance, providing financial protection to millions of policyholders worldwide. Aflac’s unique selling proposition lies in its ability to offer cash benefits directly to policyholders, which can be used for anything from medical bills to everyday living expenses.

Aflac operates on a simple yet effective principle: it supplements traditional health insurance by covering costs that primary plans often leave uncovered. For example, if you’re hospitalized due to an accident or diagnosed with a critical illness, Aflac pays you a lump sum or periodic benefits, depending on your policy. This cash benefit can help you pay for hospital stays, medical treatments, or even lost income during recovery.

Read also:Discovering Icelands Language A Journey Through Its Unique Linguistic Heritage

One of the most distinguishing features of Aflac is its flexibility. Unlike traditional health insurance, which pays benefits directly to healthcare providers, Aflac’s policies give you the freedom to use the money as you see fit. Whether you need to cover rent, groceries, or childcare, Aflac’s cash benefits provide a financial cushion during challenging times.

How Does Aflac Work? What Are the Types of Policies Offered?

Accident Insurance

Accident insurance is one of Aflac’s most popular offerings. This policy provides cash benefits if you’re injured in an accident, covering expenses like emergency room visits, ambulance rides, and even follow-up care. The benefits are paid directly to you, allowing you to focus on recovery without worrying about mounting bills.

Critical Illness Insurance

What happens if you’re diagnosed with a serious illness like cancer, heart attack, or stroke? Critical illness insurance steps in to provide a lump-sum payment. This money can be used for medical treatments, travel expenses for specialized care, or even household bills while you’re unable to work.

Hospital Indemnity Insurance

Hospital indemnity insurance pays you a set amount for each day you’re hospitalized. This can help cover costs like hospital room charges, surgeries, and other inpatient expenses. It’s an excellent complement to traditional health insurance, which may not fully cover extended hospital stays.

Short-Term Disability Insurance

Short-term disability insurance provides income replacement if you’re unable to work due to a non-work-related injury or illness. This policy ensures you can continue paying your bills while you recover, offering peace of mind during uncertain times.

How Does Aflac Work? What Are the Benefits of Aflac Policies?

How Does Aflac Work to Provide Financial Security?

Aflac’s policies are designed to offer financial security when you need it most. By providing cash benefits directly to policyholders, Aflac ensures that you have the resources to manage unexpected expenses without depleting your savings. This financial cushion can be especially valuable during emergencies when every dollar counts.

Read also:Discover The Inspiring Journey Of Symoneblust Erome A Rising Star

What Makes Aflac Stand Out from Other Insurance Providers?

Unlike traditional health insurance, which often involves complex billing and reimbursement processes, Aflac simplifies things by paying benefits directly to you. This streamlined approach eliminates the hassle of dealing with multiple parties and ensures you receive your money quickly. Additionally, Aflac’s policies are highly customizable, allowing you to tailor coverage to your specific needs.

- Flexibility: Use cash benefits for any purpose, from medical bills to daily expenses.

- Comprehensive Coverage: Aflac policies cover a wide range of scenarios, from accidents to critical illnesses.

- Quick Payouts: Aflac is known for its efficient claims process, ensuring you receive benefits promptly.

How Does the Aflac Claims Process Work?

Filing a claim with Aflac is straightforward and user-friendly. The process begins by submitting a claim form along with any required documentation, such as medical records or proof of hospitalization. Aflac’s claims team reviews the submission and processes payments quickly, often within a few days.

One of the standout features of Aflac’s claims process is its digital accessibility. Policyholders can file claims online or through Aflac’s mobile app, making it convenient to manage their accounts from anywhere. Additionally, Aflac’s customer service team is available to assist with any questions or concerns, ensuring a smooth experience.

Another advantage of Aflac’s claims process is its transparency. Policyholders receive clear explanations of their benefits and payouts, helping them understand exactly what they’re entitled to. This transparency builds trust and reinforces Aflac’s reputation as a reliable insurance provider.

Is Aflac Worth It? How Does Aflac Work for You?

How Does Aflac Work to Complement Your Existing Insurance?

Aflac’s supplemental insurance policies are designed to work alongside your primary health insurance, filling in the gaps where traditional plans fall short. For example, if your health insurance has a high deductible, Aflac’s cash benefits can help cover those costs upfront, reducing your financial burden.

What Are the Long-Term Benefits of Choosing Aflac?

Investing in Aflac can provide long-term peace of mind. By safeguarding against unexpected medical expenses, Aflac helps you avoid dipping into savings or accumulating debt. Over time, this financial protection can contribute to greater stability and security for you and your family.

Cost vs. Value

While Aflac’s premiums vary depending on the policy and coverage level, many policyholders find the cost to be well worth the value. The peace of mind that comes with knowing you’re financially protected during emergencies is invaluable, making Aflac a worthwhile investment for many.

How Does Aflac Work for Employers and Businesses?

Aflac also offers group policies for employers, providing a valuable benefit to employees. These policies can be customized to meet the needs of the workforce, offering coverage for accidents, critical illnesses, and more. By including Aflac in their benefits package, employers can enhance employee satisfaction and retention.

For businesses, Aflac’s group policies are an affordable way to provide additional financial protection to employees. The premiums are typically shared between the employer and employees, making it a cost-effective solution for everyone involved.

How Does Aflac Work? What Are the Common Misconceptions?

Is Aflac a Replacement for Health Insurance?

One common misconception is that Aflac replaces traditional health insurance. However, Aflac is designed to complement, not replace, primary health insurance. It provides additional financial support but does not cover major medical expenses like surgeries or hospital stays.

Does Aflac Only Cover Work-Related Injuries?

Another misconception is that Aflac only covers work-related injuries. In reality, Aflac’s policies cover a wide range of scenarios, including accidents, illnesses, and hospitalizations, regardless of where they occur.

Is Aflac Expensive?

While some people assume Aflac is expensive, its premiums are often affordable, especially when compared to the potential out-of-pocket costs it helps cover. The value it provides in terms of financial security makes it a cost-effective choice for many.

Frequently Asked Questions About How Aflac Works

How Does Aflac Work if I Already Have Health Insurance?

Aflac works alongside your existing health insurance by providing additional cash benefits. These benefits can help cover deductibles, copayments, and other expenses not fully covered by your primary plan.

Can I Use Aflac Benefits for Non-Medical Expenses?

Yes, Aflac’s cash benefits can be used for any purpose, including non-medical expenses like rent, groceries, or childcare. This flexibility is one of the key advantages of Aflac’s policies.

How Quickly Does Aflac Pay Out Claims?

Aflac is known for its efficient claims process, often paying out claims within a few days of submission. The exact timeline may vary depending on the complexity of the claim and the documentation required.

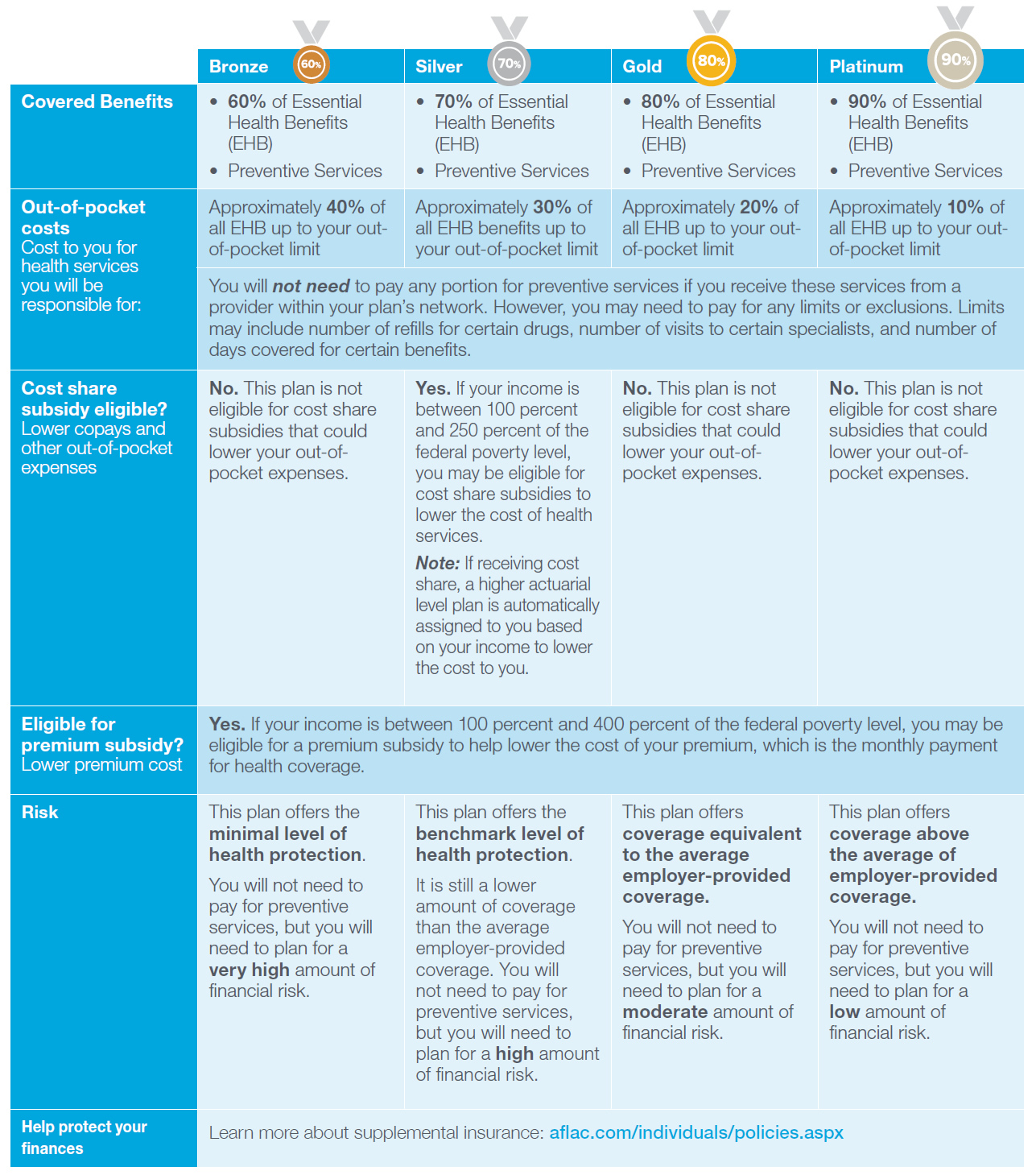

For more information about Aflac and its offerings, you can visit their official website here.

In conclusion, understanding how Aflac works can empower you to make informed decisions about your financial future. Whether you’re looking for supplemental coverage for yourself or considering group policies for your business, Aflac offers a range of options to suit your needs. By bridging the gaps left by traditional health insurance, Aflac provides peace of mind and financial security during life’s unexpected challenges.