Whether you're a first-time filer or a seasoned taxpayer, navigating the complexities of tax forms can be overwhelming. But don't worry—we’ll break it all down step by step, ensuring you have the clarity and confidence to handle your tax refund efficiently. Understanding this process not only helps you claim what’s rightfully yours but also ensures compliance with state regulations. For many Colorado residents, the 1099-G form is more than just a piece of paper—it's a key to unlocking potential financial relief. This form is issued by the Colorado Department of Revenue and provides critical details about your tax refund or other government payments received during the previous tax year. It’s essential for accurately reporting your income on your federal tax return, as certain refunds or payments may be taxable at the federal level. With so much at stake, it’s important to understand how to interpret the information on your 1099-G and what steps to take if you encounter issues. Whether you’re filing online or mailing in your return, knowing how to use this form correctly can save you time, money, and stress. The purpose of this article is to provide a comprehensive resource for anyone seeking to understand their 1099-G Colorado tax refund. From explaining the form’s purpose and how to access it online to addressing common questions and troubleshooting errors, we’ll cover all the bases. By the end of this guide, you’ll be equipped with the knowledge to navigate the tax refund process confidently and efficiently. So, let’s dive in and unravel the mysteries of the 1099-G form, ensuring you’re fully prepared for tax season.

- What Is a 1099-G Form and Why Is It Important for Colorado Taxpayers?

- How to Access Your 1099-G Colorado Tax Refund Online?

- Common Questions About the 1099-G Colorado Tax Refund

- How to Report Your 1099-G Information on Your Federal Tax Return?

- What to Do If You Didn’t Receive Your 1099-G Form?

- Understanding the Impact of Unemployment Compensation on Your 1099-G

- Tips for Avoiding Common Mistakes With Your 1099-G Form

- Frequently Asked Questions About 1099-G Colorado Tax Refund

What Is a 1099-G Form and Why Is It Important for Colorado Taxpayers?

The 1099-G form is a tax document issued by government agencies to report certain types of payments made to taxpayers during the previous year. For Colorado residents, this form is particularly important because it provides essential details about state tax refunds, unemployment compensation, or other government payments. These figures are critical for accurately filing your federal tax return, as some of these payments may be considered taxable income at the federal level. Understanding the purpose of the 1099-G form ensures that you remain compliant with tax laws while avoiding potential penalties or audits.

One of the most common reasons Colorado taxpayers receive a 1099-G form is due to a state tax refund. If you itemized deductions on your federal tax return in the prior year and claimed state and local tax (SALT) deductions, your state tax refund may be considered taxable income. The 1099-G form will report the exact amount of your refund, which you must include on your federal return. Additionally, if you received unemployment compensation, this payment will also appear on your 1099-G. Failing to report these amounts accurately can lead to discrepancies with the IRS, making it crucial to review your form carefully.

Read also:Exploring The Top 10 Biggest Hospitals In The World A Comprehensive Guide

Another reason the 1099-G form is vital for Colorado taxpayers is its role in documenting other government payments, such as disaster relief or agricultural subsidies. These payments may have specific tax implications depending on federal and state regulations. For example, certain disaster relief payments are nontaxable, while others may need to be reported as income. By reviewing your 1099-G form, you can ensure that you’re aware of all payments you received and their corresponding tax treatment. This knowledge not only helps you file your taxes correctly but also allows you to maximize deductions and credits where applicable.

How to Access Your 1099-G Colorado Tax Refund Online?

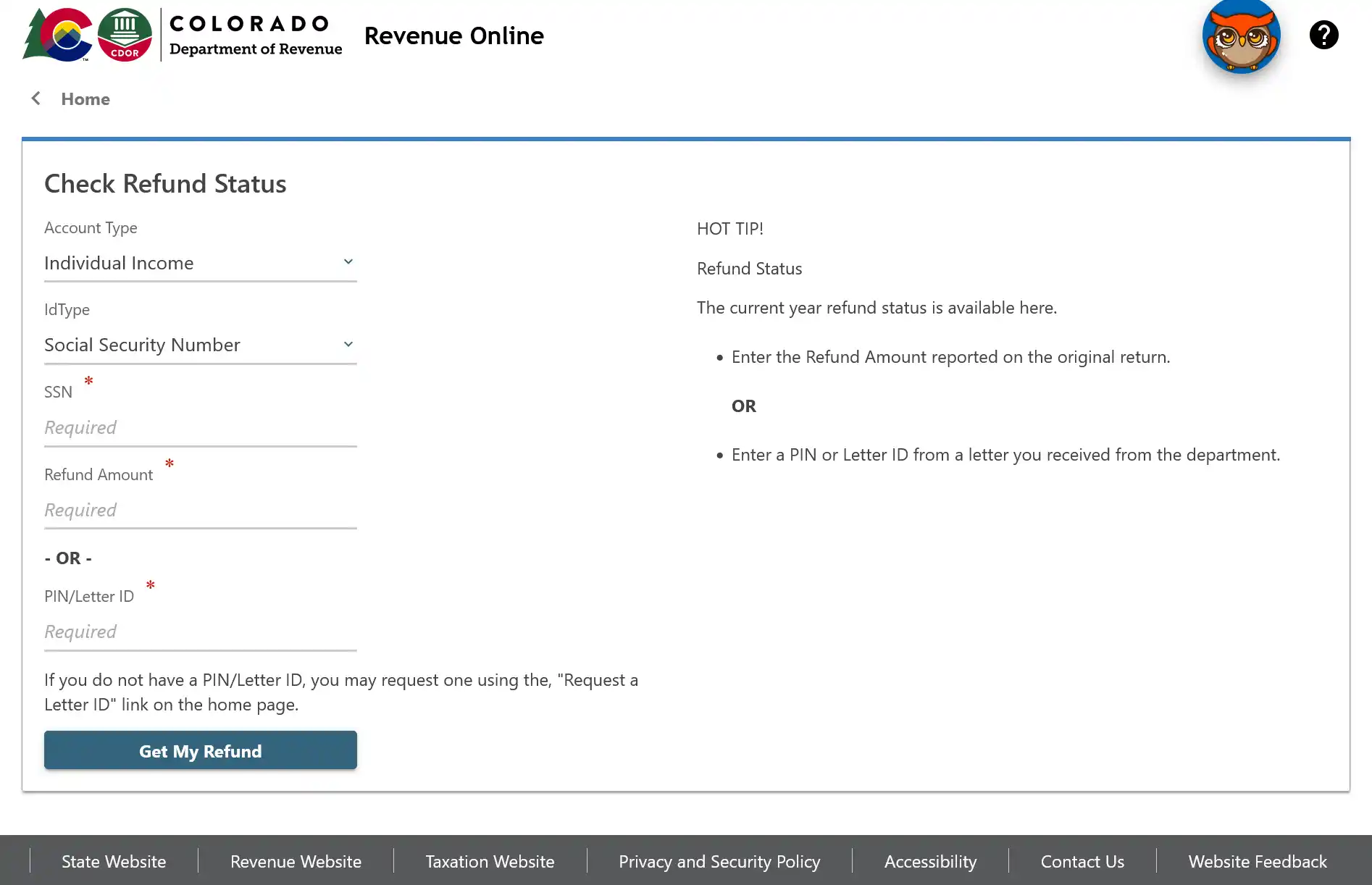

In today’s digital age, accessing your 1099-G Colorado tax refund has never been easier. The Colorado Department of Revenue provides an online portal where taxpayers can conveniently retrieve their forms. To access your 1099-G, start by visiting the official Colorado Department of Revenue website. Once there, navigate to the "Taxpayer Access" section, where you’ll find a dedicated portal for viewing and downloading your tax documents. This portal is secure and user-friendly, ensuring that your personal information remains protected while giving you quick access to your refund details.

To log in, you’ll need to create an account if you haven’t already. The registration process is straightforward and requires basic information such as your Social Security Number, date of birth, and a valid email address. Once your account is set up, you can log in to view your 1099-G form. The form is typically available by January 31st each year, giving you ample time to review it before filing your federal tax return. If you’re unable to locate your form, the portal also offers a search feature that allows you to filter documents by tax year, ensuring you find the correct form for the year in question.

For those who prefer mobile access, the Colorado Department of Revenue also offers a mobile-friendly version of their website. This allows you to check your 1099-G form on the go, ensuring you’re never caught off guard during tax season. Additionally, the portal provides helpful resources, such as FAQs and troubleshooting guides, to assist taxpayers who encounter issues. Whether you’re a tech-savvy individual or someone who’s new to online tax tools, accessing your 1099-G Colorado tax refund online is a seamless process that saves time and reduces paperwork. By taking advantage of this convenient option, you can stay organized and ensure your tax filing goes smoothly.

Common Questions About the 1099-G Colorado Tax Refund

As tax season approaches, many Colorado taxpayers have questions about their 1099-G forms and how they impact their refunds. Below, we’ll address some of the most frequently asked questions to help clarify common concerns and ensure you’re well-prepared for filing.

What Should You Do If Your 1099-G Form Has Errors?

Errors on your 1099-G form can cause confusion and potentially lead to issues with the IRS if not addressed promptly. Common mistakes include incorrect refund amounts, wrong Social Security Numbers, or missing information. If you notice an error, the first step is to contact the Colorado Department of Revenue directly. They have a dedicated customer service team that can assist with corrections and issue an updated form if necessary. It’s important to act quickly, as unresolved errors could delay your federal tax filing or result in an audit. Keep records of all communications and ensure you receive confirmation once the issue is resolved.

Read also:Exploring Dollyflesh A Comprehensive Guide To Understanding And Appreciating

Is Your 1099-G Colorado Tax Refund Taxable?

Whether your 1099-G Colorado tax refund is taxable depends on how you filed your federal tax return in the prior year. If you itemized deductions and claimed state and local tax (SALT) deductions, your state tax refund may be considered taxable income. This is because the IRS views the refund as a reimbursement of taxes that were previously deducted. On the other hand, if you took the standard deduction, your state tax refund is generally not taxable. Unemployment compensation, however, is almost always taxable at the federal level, so it’s crucial to report this amount accurately. Consulting a tax professional can help clarify your specific situation and ensure compliance with tax laws.

How to Report Your 1099-G Information on Your Federal Tax Return?

Reporting your 1099-G information on your federal tax return is a critical step to ensure accuracy and compliance with IRS regulations. To begin, gather your 1099-G form and review it carefully to confirm that all the information is correct. The form will include details such as your state tax refund, unemployment compensation, or other government payments. Depending on your filing status and deductions from the previous year, some of these amounts may need to be reported as taxable income. Understanding how to navigate this process can save you time and prevent potential issues with the IRS.

If your 1099-G includes a state tax refund, you’ll need to determine whether it’s taxable. This depends on whether you itemized deductions on your federal return in the prior year. If you claimed state and local tax (SALT) deductions, your state tax refund must be reported as income on your federal return. To do this, locate the appropriate section of your federal tax form, such as Schedule 1 (Form 1040), and enter the refund amount under the "Additional Income" section. If you didn’t itemize deductions, your state tax refund is generally not taxable, and no further action is required. However, it’s always a good idea to double-check your prior-year tax return to confirm your filing method.

Unemployment compensation, another common item reported on the 1099-G, is almost always taxable at the federal level. To report this income, enter the total amount from Box 1 of your 1099-G on Line 7 of your Form 1040. If you live in Colorado, it’s important to note that unemployment benefits are also taxable at the state level, so you may need to account for this when filing your state return. For taxpayers who received other government payments, such as disaster relief or agricultural subsidies, review IRS guidelines to determine whether these amounts are taxable. By accurately reporting all relevant information from your 1099-G, you can ensure a smooth filing process and avoid unnecessary complications with the IRS.

What to Do If You Didn’t Receive Your 1099-G Form?

If you haven’t received your 1099-G form by the end of January, it’s natural to feel concerned, especially with tax deadlines looming. However, there are several steps you can take to address the situation and ensure you have the necessary information to file your taxes accurately. The first step is to verify whether the form was sent to the correct address. Check your account on the Colorado Department of Revenue’s online portal to confirm your mailing address and ensure there were no errors in delivery. If your address is correct and you still haven’t received the form, it’s time to take further action.

Next, consider reaching out to the Colorado Department of Revenue directly. Their customer service team can help determine whether your 1099-G form was issued and provide guidance on how to retrieve it. In many cases, they can send you a duplicate copy or provide access to the form online. If you’re unable to resolve the issue through customer service, you can also request a copy of your 1099-G by submitting a formal request via mail or email. Be sure to include your full name, Social Security Number, and the tax year in question to expedite the process. While waiting for your form, gather any supporting documents, such as your prior-year